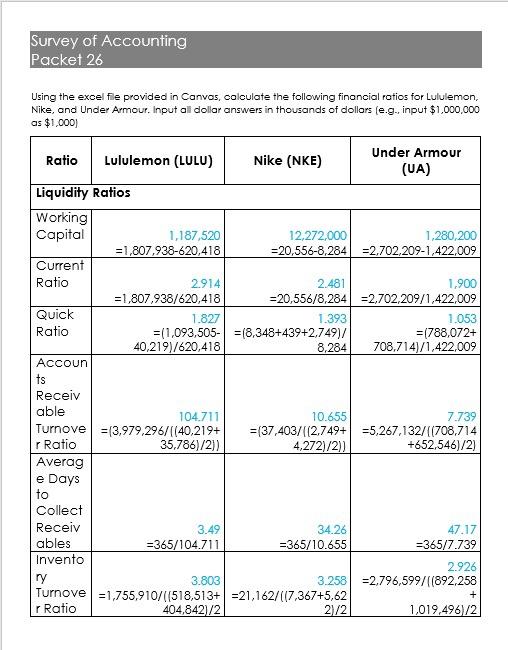

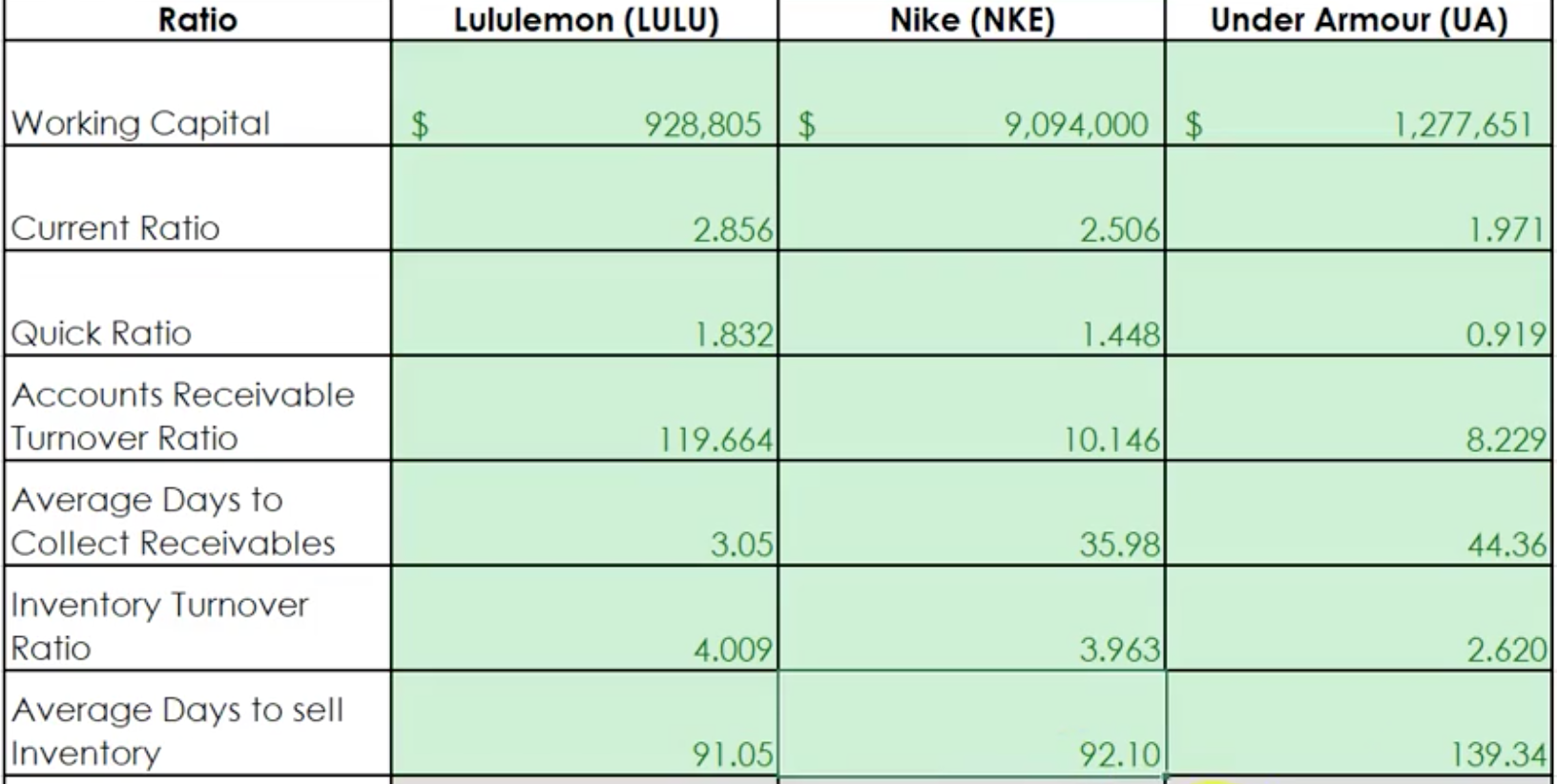

Ch 2 Nike Worksheet.docx - Ch 2 p.54-55 Case Analysis: Nike vs UnderArmour You may work together, but attach the work for the ratios you compute and | Course Hero

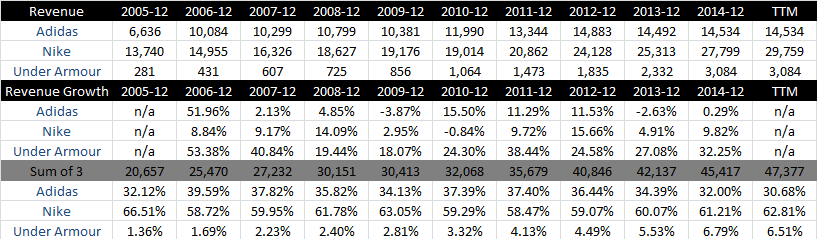

Under Armour Under Pressure Ratio Analysis.pdf - For the exclusive use of C. Cardenas 2021. W18648 UNDER ARMOUR UNDER PRESSURE: RATIO | Course Hero

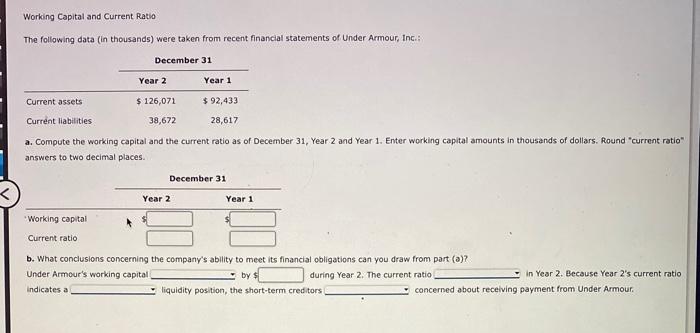

![Solved] Under Armour, Inc. is an American supplie | SolutionInn Solved] Under Armour, Inc. is an American supplie | SolutionInn](https://s3.amazonaws.com/si.question.images/images/question_images/1547/8/3/1/7315c4209b3195ac1547814374632.jpg)